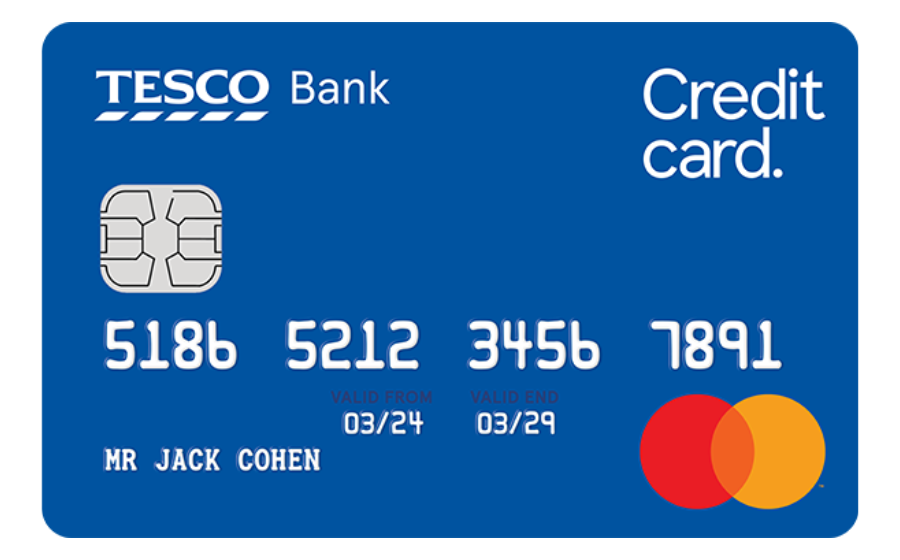

For those aiming to rebuild their credit or establish a stronger financial footing, the Tesco Bank Foundation Credit Card offers a practical solution.

Designed with simplicity in mind, it comes with no annual fee and earns Tesco Clubcard points on eligible purchases, adding a touch of reward to everyday spending.

Its manageable credit limits and monthly credit reporting make it an excellent choice for improving your credit profile over time. Read on to discover how this card could support your financial goals.

Tesco Bank Foundation Credit Card

| Annual Fee | £0 |

| Credit Limit | £250 to £1,500 |

| Representative APR | 29.9% (variable) |

| Purchase Rate | 29.9% p.a. (variable) |

| Welcome Bonus | None |

| Rewards | None |

A Quick Look at What Tesco Bank Foundation Credit Card Offers

Improving your credit score can feel like a challenge, but Tesco Bank makes it easier with its Foundation Credit Card. Known for its trusted reputation in the UK’s financial sector, Tesco Bank offers a practical solution for those aiming to rebuild or strengthen their financial profile.

Designed specifically for credit improvement, this card stands out with no annual fee, manageable credit limits, and the added bonus of earning Tesco Clubcard points on eligible purchases.

Compared to other cards on the market, it combines the benefits of credit-building tools with everyday rewards, making it a competitive option for individuals with modest credit histories.

With Tesco Bank’s emphasis on security and customer support, the Foundation Credit Card offers a reliable way to take control of your finances while enjoying the perks of Tesco’s extensive rewards system.

Who Should Consider Tesco Bank Foundation Credit Card?

For those working to improve their credit score, the Tesco Bank Foundation Credit Card offers a practical and supportive solution. It’s particularly well-suited to individuals with limited credit histories, such as students or those recovering from past financial difficulties.

Additionally, its straightforward benefits, like no annual fee and Tesco Clubcard rewards, make it an appealing option for everyday spenders. With manageable credit limits and monthly reporting to credit agencies, this card helps users rebuild their financial standing in a secure and responsible way. It’s a solid step towards better financial health.

Minimum Credit Score: Can You Qualify?

The Tesco Bank Foundation Credit Card is tailored for individuals aiming to build or improve their credit history. It offers starting credit limits between £250 and £1,500, with the potential for regular increases when managed responsibly.

Experian™ Credit Score Requirement

Poor (0 – 560) | Fair (561 – 720) | Good (721 – 880) | Very Good (881 – 960) | Excellent (961 – 999)

Additionally, cardholders can collect Clubcard points on almost every purchase, enhancing the value of everyday spending. This card provides a practical and secure way to manage finances while working towards a stronger credit profile.

Ready to Apply? Here’s How to Start

Applying for the Tesco Bank Foundation Credit Card is straightforward and user-friendly. Start by visiting Tesco Bank’s official website, where you can use the eligibility checker to see your chances of approval without affecting your credit score.

If eligible, complete the online application by providing details about your income, employment, and financial history. This card is ideal for those working to build credit, manage finances responsibly, or earn rewards through Tesco Clubcard points. For more details and to begin your application, head to Tesco Bank’s website today!

Tesco Bank Foundation Credit Card

Credit Card Application Process

Check Your Eligibility

Use the eligibility checker to see your chances of approval without impacting your credit score.

Fill Out the Online Application Form

Complete the application form with personal and financial details for a smooth process.

Submit and Wait for Assessment

The Post Office will review your information to determine eligibility and terms.

Receive Your Decision

Get notified of your approval status and review the terms if accepted.

How Tesco Bank Foundation Credit Card’s Limits Work

Managing your finances with the Tesco Bank Foundation Credit Card is straightforward, but understanding its terms is key. The card’s variable APR is typically above 27%, which means carrying a balance can quickly become costly. Credit limits start modestly, ranging between £250 and £1,500, but with responsible usage and on-time payments, these limits may increase over time.

To get the most from this card, aim to pay off your balance in full each month, avoiding interest charges. Additionally, earning Tesco Clubcard points on eligible purchases adds extra value to everyday spending. By keeping within your credit limit and maintaining timely payments, you can improve your credit score while enjoying practical benefits. Remember, this card is best for rebuilding credit rather than for those who plan to carry high balances.

Tools & Support: Managing Tesco Bank Foundation Credit Card with Ease

Managing the Tesco Bank Foundation Credit Card is made simple with user-friendly tools and robust support. The Tesco Bank mobile app allows you to track spending, make payments, and set up alerts, keeping your finances under control. Additionally, 24/7 phone support ensures assistance is always available when needed.

Security features like fraud protection and suspicious activity alerts provide peace of mind, safeguarding your account against unauthorised transactions. While the card can be used abroad, international transactions incur fees, making it less ideal for frequent travellers.

By offering a blend of convenience, security, and responsive customer support, Tesco Bank ensures that cardholders can manage their finances confidently and efficiently, no matter where they are. It’s an excellent choice for those prioritising financial control and security.

Tesco Bank Foundation Credit Card or Santander All in One Credit Card – Which is Better?

When comparing the Tesco Bank Foundation Credit Card with the Santander All in One Credit Card, key differences emerge, catering to distinct financial needs. The Tesco card is specifically designed for individuals looking to rebuild or establish their credit. It features no annual fee, manageable credit limits, and Tesco Clubcard rewards, making it ideal for credit improvement and everyday spending.

On the other hand, the Santander All in One Credit Card offers broader perks for established credit users. It includes 0.5% cashback on all purchases, no foreign transaction fees, and up to 26 months of 0% interest on purchases and balance transfers. However, it comes with a £3 monthly fee.

If your priority is rebuilding credit, the Tesco card is a practical choice. However, for those seeking rewards and travel-friendly features, the Santander card provides greater versatility and value.