Building or improving your credit doesn’t have to be complicated, and this card makes the process manageable. Designed for individuals starting their financial journey or recovering from past challenges, it provides practical benefits like no annual fee, flexible credit limits, and free credit monitoring.

These features offer both simplicity and support, making it a strong contender for those focusing on financial growth. Ready to learn more? Let’s delve into the details to see if this card aligns with your goals.

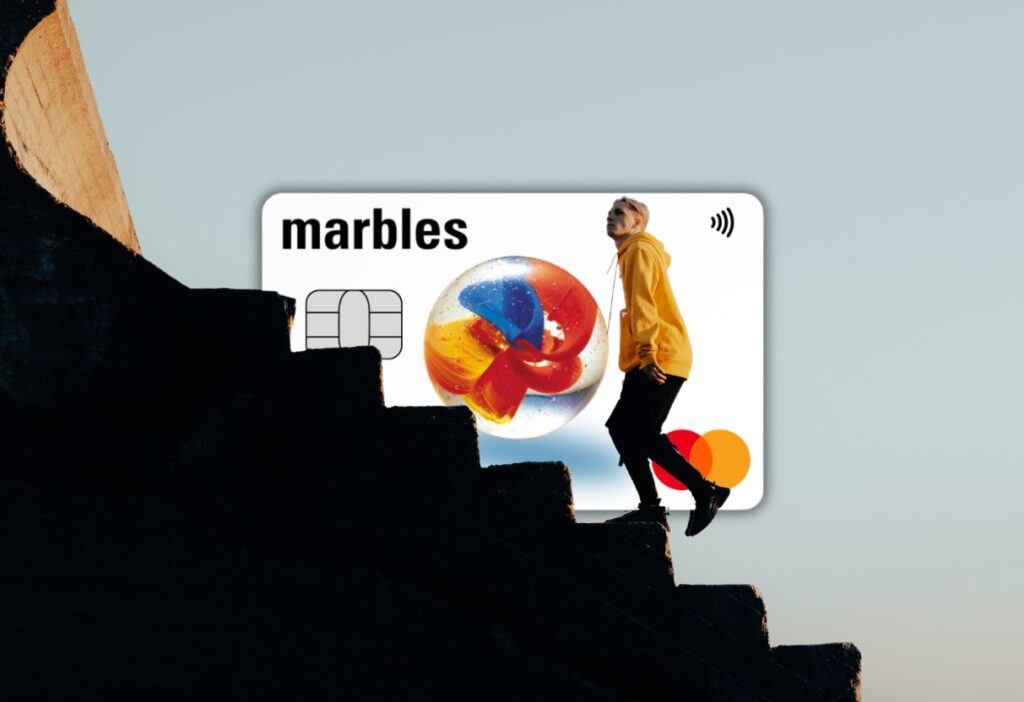

Marbles Credit Card

| Annual Fee | £0 |

| Credit Limit | £250 to £1,500 |

| Representative APR | 34.9% (variable) |

| Purchase Rate | Variable |

| Welcome Bonus | None |

| Rewards | None |

6,606 reviews on Trustpilot

A Quick Look at What Marbles Credit Card Offers

When it comes to credit cards designed to help you build or improve your credit score, Marbles offers a practical and trusted option backed by NewDay, a respected name in UK finance.

This card focuses on simplicity, providing features like no annual fee, flexible credit limits, and free credit score tracking. Compared to other credit-building cards, it stands out for its accessible tools and straightforward benefits, designed to support financial growth.

Moreover, Marbles ensures users feel secure with robust fraud protection and transparent policies, earning the trust of its customers.

Whether you’re starting your credit journey or recovering from past financial challenges, this card delivers both reliability and peace of mind, making it a solid choice for those seeking to improve their financial standing responsibly. Let’s explore its features in more detail to see how it measures up.

Who Should Consider Marbles Credit Card?

This card is a fantastic fit for anyone focused on building or rebuilding their credit. Whether you’re a student managing your first financial responsibilities, a freelancer navigating irregular income, or someone with limited credit history, the Marbles Credit Card provides tools to support your goals.

With features like no annual fee, flexible credit limits, and free credit monitoring, it offers a secure and practical way to manage finances effectively. Moreover, it’s designed to grow with you, rewarding responsible use by increasing credit limits over time.

Minimum Credit Score: Can You Qualify?

Approval for this card doesn’t require a perfect credit score, making it accessible to those with a limited or poor credit history. While no minimum score is officially stated, the decision hinges on your affordability and financial circumstances.

Experian™ Credit Score Requirement

Poor (0 – 560) | Fair (561 – 720) | Good (721 – 880) | Very Good (881 – 960) | Excellent (961 – 999)

Additionally, your credit history influences the initial credit limit offered—those demonstrating more responsible financial habits might see a slightly higher limit. By focusing on supporting users through practical tools and manageable limits, this card creates opportunities to improve credit without unnecessary hurdles.

Ready to Apply? Here’s How to Start

Applying for the Marbles Credit Card is quick and straightforward. Start by visiting the official Marbles website, where you can use their eligibility checker to see your chances of approval without affecting your credit score. If eligible, proceed with the online application by filling in your personal and financial details.

This card is ideal for those aiming to build or rebuild credit, offering tools to support responsible financial management. For more details or to begin your application, head over to the Marbles website and take the first step toward improving your credit today.

Marbles Credit Card

Credit Card Application Process

Check Your Eligibility

Use the eligibility checker to see your chances of approval without impacting your credit score.

Fill Out the Online Application Form

Complete the application form with personal and financial details for a smooth process.

Submit and Wait for Assessment

The Post Office will review your information to determine eligibility and terms.

Receive Your Decision

Get notified of your approval status and review the terms if accepted.

How Marbles Credit Card’s Limits Work

High-interest rates make it essential to pay off balances in full each month, helping you avoid unnecessary costs. Credit limits start modestly, reflecting your financial circumstances during application, but they can grow with consistent and responsible use over time.

Moreover, the card’s free credit monitoring tools provide insights into your progress, helping you manage your finances effectively. By focusing on low balances and timely payments, you can maximise the card’s benefits while building a stronger financial profile.

Tools & Support: Managing Marbles Credit Card with Ease

Staying in control of your finances is simple with the range of tools provided. The mobile app makes it easy to monitor transactions, set payment reminders, and access free credit score updates. In terms of security, robust fraud protection and instant alerts for any suspicious activity help keep your card safe.

Moreover, email and text notifications ensure you never miss a payment, reducing the risk of late fees. While you can use the card internationally, it’s worth noting that fees may apply to foreign transactions.

For further assistance, reliable phone support is available, making it convenient to address any issues or concerns. These features work together to provide both security and flexibility for your financial management needs.

Marbles Credit Card or Aqua Classic Credit Card – Which is Better?

When comparing the Marbles Credit Card to the Aqua Classic Credit Card, both are strong contenders for individuals looking to build or rebuild credit. However, they cater to slightly different needs.

The Marbles Credit Card offers flexible credit limits, no annual fee, and access to free credit score tracking, making it ideal for those prioritising financial tools and security. On the other hand, the Aqua Classic Credit Card also has no annual fee and provides free credit monitoring, but it stands out with its QuickCheck tool, which allows applicants to assess eligibility without impacting their credit score.

For users who value a straightforward application process, Aqua Classic may have the edge. However, Marbles offers a more robust mobile app for account management. Both cards suit those focusing on credit improvement, so the choice depends on whether application convenience or account tools are your priority.