For those who frequently travel or shop abroad, the Halifax Clarity Card offers a simple and cost-effective way to manage spending. With no annual fee and no foreign transaction fees, it’s an ideal choice for international purchases.

Additionally, the card features low cash withdrawal rates, making it easy to access funds when needed. Whether you’re heading on a trip or simply looking for a convenient way to spend abroad, this card provides the flexibility and savings you need. Keep reading to find out more about how it can work for you.

Halifax Clarity Card

| Annual Fee | £0 |

| Credit Limit | Subject to status |

| Representative APR | Subject to status |

| Purchase Rate | Subject to status |

| Welcome Bonus | None |

| Rewards | None |

A Quick Look at What Halifax Clarity Card Offers

Certainly! Let me rewrite the introduction with varied phrasing and effective transitions to maintain a smooth and engaging flow:

For those seeking a credit card that simplifies spending at home and abroad, Halifax offers the Clarity Credit Card—a strong contender in the UK market. Backed by Halifax’s reputation for reliability and robust financial solutions, this card delivers a no-nonsense approach to managing your money.

What sets the Clarity Card apart is its fee-free international transactions, making it an excellent choice for frequent travellers. Unlike many cards that sneak in additional charges, this one keeps things refreshingly straightforward.

In addition to its travel benefits, Halifax’s longstanding presence in the financial sector inspires confidence. With a focus on transparency and customer support, you’ll find peace of mind whether managing your budget locally or enjoying adventures overseas.

Who Should Consider Halifax Clarity Card?

Whether you’re a frequent traveller avoiding hefty overseas fees or a freelancer seeking a reliable card for everyday expenses, the Halifax Clarity Credit Card caters to diverse financial needs. Ideal for those who value practicality and transparency, this card offers fee-free international transactions and straightforward terms that simplify money management.

In addition, it’s a solid choice for students or individuals with limited credit history, providing a secure path to building financial independence. For anyone prioritizing a hassle-free and trustworthy solution, this card checks all the boxes, making it a versatile tool for a range of lifestyles.

Minimum Credit Score: Can You Qualify?

When it comes to applying for a credit card, your overall credit profile matters more than a single number. For the Halifax Clarity Credit Card, there’s no set minimum credit score, but having a strong credit history increases your chances of approval.

Moreover, those with a solid financial track record may enjoy better terms, like higher credit limits and lower interest rates. On the other hand, applicants with limited or patchy credit histories might face stricter conditions. Checking your credit score beforehand ensures you’re prepared, giving you a clearer picture of your eligibility and room for improvement if needed.

Experian™ Credit Score Requirement

Poor (0 – 560) | Fair (561 – 720) | Good (721 – 880) | Very Good (881 – 960) | Excellent (961 – 999)

Ready to Apply? Here’s How to Start

Applying for the Halifax Clarity Credit Card is a simple and straightforward process designed to suit a variety of users. Start by using Halifax’s ‘Simple Check’ eligibility tool, which provides an estimated credit limit and likelihood of approval in just a few minutes—without impacting your credit score.

Once you’re ready, gather your personal information, including address history for the past three years, income, and employment details. With everything prepared, complete the secure online application form available on the Halifax website.

After submission, your application will be assessed based on your financial details and credit history. If approved, your card will be sent to you shortly. Perfect for frequent travellers and anyone looking for a fee-free, no-fuss credit card, the Halifax Clarity Card offers exceptional value. For more details or to start your application, visit Halifax’s official website.

Halifax Clarity Card

Credit Card Application Process

Check Your Eligibility

Use the eligibility checker to see your chances of approval without impacting your credit score.

Fill Out the Online Application Form

Complete the application form with personal and financial details for a smooth process.

Submit and Wait for Assessment

The Post Office will review your information to determine eligibility and terms.

Receive Your Decision

Get notified of your approval status and review the terms if accepted.

How Halifax Clarity Card’s Limits Work

Managing your finances with the Halifax Clarity Credit Card is straightforward, but understanding its terms can make all the difference. With a variable Annual Percentage Rate (APR) typically around 23.9%, your exact rate depends on your financial profile. One standout feature is the absence of fees for foreign transactions and cash withdrawals abroad, although interest on cash withdrawals starts accruing immediately—making prompt repayment a wise move.

Moreover, credit limits are set based on factors such as your income and credit history, with the potential for increases over time through responsible use. To get the most out of this card, consider paying off your balance in full each month to avoid interest charges. Setting up a Direct Debit ensures timely payments and allows you to take full advantage of its benefits without unnecessary costs.

Tools & Support: Managing Halifax Clarity Card with Ease

When it comes to tools and customer support, the Halifax Clarity Credit Card offers a range of features designed to make life easier. The Halifax mobile app is a standout, providing real-time transaction tracking, instant balance updates, and the ability to set spending alerts. In addition, customer service is accessible via phone support, with trained representatives ready to assist with any concerns.

Security is also a priority. Advanced fraud protection actively monitors your account for suspicious activity, with immediate alerts if something looks off. Moreover, the card’s zero-liability policy ensures you won’t be held responsible for unauthorised charges.

For those travelling abroad, the card shines with its fee-free foreign transactions and ATM withdrawals. Whether at home or overseas, you can rely on Halifax to keep your finances secure and accessible.

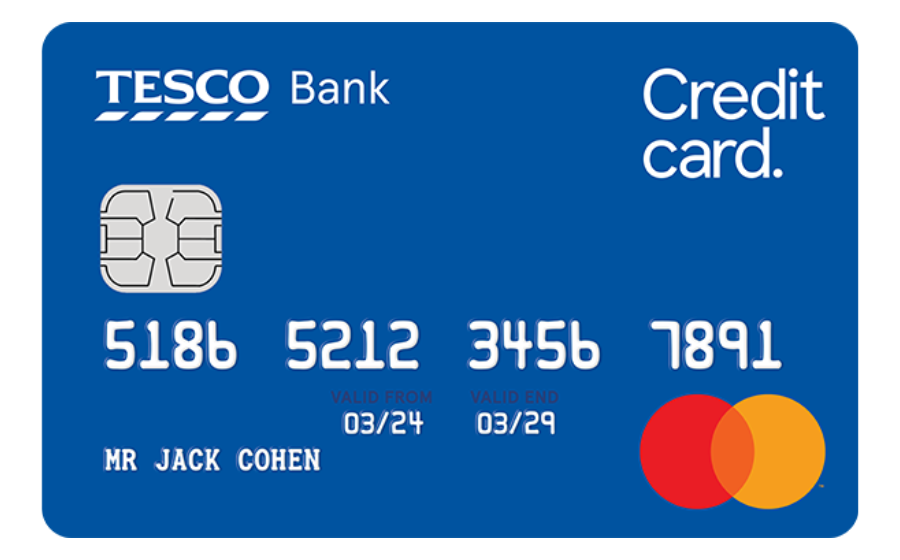

Halifax Clarity Card or Tesco Bank Low Fee Balance Transfer Credit Card – Which is Better?

When comparing the Halifax Clarity Credit Card and the Tesco Bank Low Fee Balance Transfer Credit Card, each serves distinct financial needs, making the choice dependent on your priorities.

The Halifax Clarity Credit Card is a standout option for frequent travellers, offering fee-free foreign transactions and cash withdrawals abroad. However, interest on cash withdrawals begins accruing immediately, so timely repayments are key. It’s ideal for those who prioritise seamless international spending without hidden fees.

On the other hand, the Tesco Bank Low Fee Balance Transfer Credit Card excels in debt management, featuring a 0% interest rate on balance transfers for up to 17 months and a low 0.99% transfer fee. This makes it an excellent tool for consolidating existing credit card debt and reducing interest costs over time.

For frequent travellers, the Halifax Clarity Card’s lack of fees for overseas spending makes it a clear winner. Meanwhile, individuals looking to simplify and pay off credit card debt will find greater value in the Tesco Bank Low Fee Balance Transfer Card. Your choice ultimately depends on whether you’re seeking travel convenience or debt repayment efficiency.