Find the most advantageous private health insurance plans tailored for you

Anúncios

What You Gain with Private Health Insurance

Choosing private health insurance in the UK offers a range of advantages that can significantly improve your healthcare experience.

Firstly, you gain faster access to medical treatment, bypassing long NHS waiting lists for consultations, diagnostics, and elective surgeries. This means less stress and quicker recovery times when you need care most.

Secondly, private insurance provides the freedom to choose your consultant or specialist, giving you greater control over who manages your treatment.

Another key benefit is the option for private hospital accommodation, offering more comfort, privacy, and often enhanced amenities during your stay.

Finally, many policies include extras such as mental health support, physiotherapy, and dental care, adding further value and convenience to your health cover.

Private Health Insurance

Bupa Private healthcare

If you’re self-employed or run your own business, private insurance offers valuable security, ensuring you can access treatment quickly without risking prolonged downtime.

Families with young children may also benefit, as it provides faster access to paediatric care and specialist consultations, offering peace of mind when health concerns arise.

Older adults, particularly those with specific health concerns, might appreciate the shorter waiting times and the additional comfort of private hospital facilities.

Finally, anyone who values greater choice, flexibility, and privacy during medical treatment should seriously consider private health insurance as a way to enhance their healthcare experience.

Private Health Insurance

AXA PPP Healthcare

How to Compare Private Health Insurance Plans

When comparing private health insurance plans, it’s essential to focus on what truly matters: coverage, costs, and flexibility. Start by evaluating the types of treatments and services each plan includes — some offer comprehensive coverage, while others focus on specific needs like dental care or mental health support.

Private Health Insurance

Vitality Healthcare

Next, review the costs beyond just monthly premiums. Consider deductibles, co-payments, and any exclusions that may affect your out-of-pocket expenses.

Compare the benefits of the best plans available in the UK

| Inpatient | Outpatient | Mental Health | Dental | |

| Bupa | Comprehensive cover for private hospital treatment, including surgery and inpatient care. | Full cover for diagnostics and outpatient treatments. | Cover for various mental health conditions, including up to 45 days of psychiatric treatment per year. | From 1st August 2024, all new and existing customers are entitled to a dental allowance as part of the core cover. |

| AXA PPP | Option to include cover for inpatient and day-patient care. | Option to include cover for diagnostic and outpatient care. | Option to include cover for mental health, including outpatient treatment and hospitalisation. | Does not cover dental procedures. |

| Vitality | Standard cover includes full inpatient treatment. | Standard outpatient cover limited to £500 per year; options available to increase or remove the limit. | Optional mental health cover includes up to £1,500 for outpatient treatment and up to 28 days of inpatient care per episode. | Cover for emergency dental treatment, accidents, and dental injuries, up to £2,500 per claim, with a limit of two claims per year. |

| Aviva | Core cover includes hospital treatment and day-patient care. | Cover for diagnostic and outpatient treatment. | Optional mental health support covers outpatient care and up to 28 days of inpatient treatment for acute psychiatric conditions. | Optional dental cover includes up to £250 for routine dental treatment and up to £600 for accident-related treatment. |

| Simplyhealth | Does not offer cover for inpatient hospital care. | Does not offer cover for outpatient care. | Access to 24/7 counselling consultations. | Dedicated dental plans starting from £11.55 per month, covering check-ups, treatments, and emergencies. |

Also, assess the provider network and the ease of accessing specialists, hospitals, and additional services. A good plan offers not only broad coverage but also convenience and speed when you need care most.

Finally, check for any extras such as wellness programs, virtual consultations, or international coverage that may add value.

Private Health Insurance

Aviva Healthcare

Taking the time to carefully compare these aspects will help you choose a plan that aligns with your health priorities and budget.

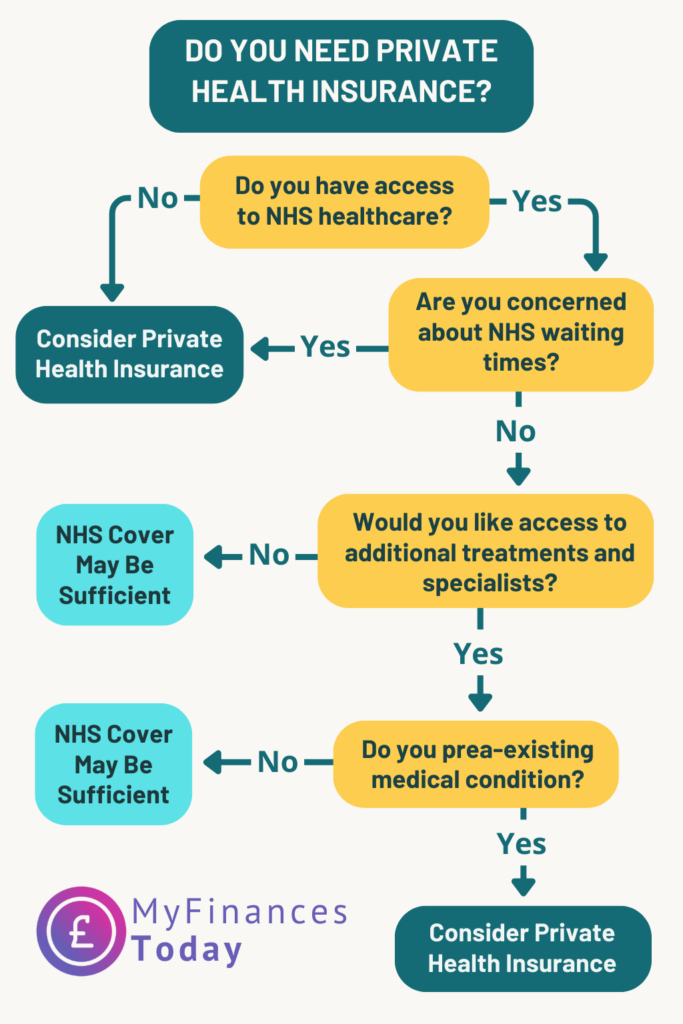

How Can You Tell If Private Health Insurance Is the Right Choice?

Private health insurance isn’t mandatory in the UK, but it can make a significant difference to your healthcare experience.

While the NHS provides excellent care, waiting times for non-urgent procedures can be long, and you may have limited choice when it comes to specialists and facilities.

Private health insurance offers quicker access to treatment, private hospital rooms, and a broader selection of consultants.

However, it comes at an additional cost, so it’s important to weigh the benefits against your personal circumstances.

Are you looking for peace of mind, faster care, or more comfort during treatment? If so, private health insurance could be a smart investment.

Private Health Insurance

Simplyhealth

Do You Have Access to NHS Healthcare?

If you don’t have access to NHS healthcare — for example, if you’re a new resident or an expat without entitlement — private health insurance is essential to ensure you can access the treatment you need.

Without NHS access, private insurance can provide peace of mind, ensuring you receive medical care when necessary, without delays or uncertainty.

If you do have NHS access, consider whether its limitations affect your health needs.

Are You Concerned About NHS Waiting Times?

The NHS is known for long waiting lists, especially for non-urgent treatments and specialist consultations.

If waiting isn’t a concern, and you’re comfortable with the standard NHS services, you may not need private health insurance at this time.

If long waits are unacceptable for you or your family, private insurance could offer faster access and greater convenience.

Would You Like Access to Additional Treatments and Specialists?

Private insurance expands your choices beyond NHS limitations, offering access to a broader range of specialists and treatments not always covered publicly.

If you’re satisfied with NHS options, there may be no immediate need for private coverage.

If you’d prefer more flexibility or specialist care, private insurance can significantly enhance your healthcare experience.

Do You Have a Pre-existing Medical Condition?

This can affect your access to certain treatments or influence waiting times within the NHS.

With private insurance, you may receive tailored care and quicker access to treatment for your condition, reducing potential delays or restrictions.

If you don’t have any pre-existing conditions, and the NHS meets your current needs, private insurance may not be essential right now.

Potential Drawbacks

While private health insurance offers numerous advantages, it’s important to be aware of potential drawbacks before making a decision.

Firstly, the cost — monthly premiums can be significant, especially for comprehensive coverage or for those with pre-existing medical conditions. You’ll need to assess whether the benefits justify the expense based on your personal circumstances.

Secondly, private insurance often comes with limitations and exclusions. Certain treatments, chronic conditions, or pre-existing issues may not be fully covered, depending on the policy.

Additionally, even with insurance, there may be out-of-pocket costs, such as excess fees or co-payments for specific services.

Finally, navigating the complexity of policies can be challenging, making it essential to carefully compare providers and read the fine print.

Now, one last question: What’s the best health plan for you?

Private health insurance in the UK isn’t one-size-fits-all — different people have different needs. Whether you’re a busy professional, planning for your family’s future, or simply looking for a cost-effective option, the best plan depends on your lifestyle, budget, and priorities.

To help you find the right fit, we’ve identified five common user types and matched each with the most suitable health insurance provider based on coverage strengths, flexibility, and value.

Which Type of Health Insurance User Are You?

When it comes to choosing the right private health insurance, one of the most important things is identifying your personal needs. Are you focused on speed and convenience? Looking to protect your entire family? Or perhaps you’re seeking a plan that fits a modest budget?

Below, we explore five typical user types and match them with the health insurance plan that best suits their lifestyle and priorities.

A. The Busy Professional

Busy professionals often find it difficult to prioritise their health. Between long working hours, high-pressure deadlines, and packed calendars, time is a limited resource. Vitality Health Insurance is designed with this lifestyle in mind. It offers rapid access to GP appointments and digital consultations, which can save hours otherwise spent waiting for NHS services.

Beyond speed, Vitality actively encourages a healthier lifestyle through its reward programmes. If you’re someone who enjoys staying active — or wants extra motivation to do so — you’ll benefit from perks like gym discounts and wearable tech incentives. It’s more than just cover; it’s a holistic approach to well-being.

Ideal Plan: Vitality

B. The Growing Family

For families, especially those with young children, peace of mind is everything. Bupa is widely regarded as one of the most trusted names in UK healthcare and offers extensive support for parents, children, and even maternity services. With access to a wide hospital network and child-friendly specialists, Bupa is ideal for families who want comprehensive cover that grows with them.

Additionally, Bupa’s family plans allow for flexibility — perfect for households with varying healthcare needs. Whether it’s regular check-ups, mental health support for teenagers, or prenatal care, Bupa has your loved ones covered.

Ideal Plan: Bupa

C. The Senior Retiree

As we get older, healthcare becomes more about prevention, management of chronic conditions, and having fast access to specialists. AXA PPP Healthcare is particularly strong in this area, offering extensive consultant access, specialist referrals, and support for age-related conditions.

Retirees who value personal attention and reliability will find AXA’s services tailored to long-term care. From joint issues to vision care and heart health, the plan helps ensure your later years are supported with dignity and confidence.

Ideal Plan: AXA PPP

D. The Cost-Conscious Individual

If you’re looking for affordable private cover without compromising too much, Simplyhealth is a great entry point. It offers modular plans that let you pay only for what you really need — perfect for students, freelancers, or anyone on a tighter budget.

Rather than full hospital cover, Simplyhealth focuses on essentials like dental, optical, and physiotherapy treatments. It’s simple, straightforward, and gives you a safety net without breaking the bank.

Ideal Plan: Simplyhealth

E. The Balanced Planner

Not too pricey, not too basic — Aviva is a smart choice for those who want comprehensive health insurance at a fair cost. It’s designed for people who like to plan ahead, compare value, and feel secure knowing they’re covered.

Aviva offers customisable policies, reliable customer service, and strong digital tools. Whether you’re managing a stable career, planning for future health needs, or covering dependents, Aviva gives you the flexibility to do it all.

Ideal Plan: Aviva

| User Type | Ideal Plan | Why This Plan Works | Full Review |

|---|---|---|---|

| Busy Professional | Vitality | Great for mental health, fitness rewards, fast appointments | Plan's Details |

| Growing Family | Bupa | Trusted family care, wide hospital network | Plan's Details |

| Senior Retiree | AXA PPP | Strong specialist access, elderly-focused plans | Plan's Details |

| Cost-Conscious | Simplyhealth | Budget-friendly, modular cover | Plan's Details |

| Balanced Planner | Aviva | Reliable, flexible, great value | Plan's Details |

Choosing the right private health insurance plan can feel overwhelming, but focusing on a few key factors can simplify the process.

Start by reviewing the level of cover provided — does the policy include inpatient, outpatient, mental health, and dental care? Make sure the essentials you value most are adequately protected.

Next, assess the cost. Compare monthly premiums, excess amounts, and any co-payments required for treatment. A cheaper policy might offer less comprehensive cover, so balance affordability with your healthcare needs.

Also, consider the provider network — are your preferred consultants, hospitals, and clinics included?

Finally, check for additional benefits such as wellness programmes, mental health support, or physiotherapy.

Taking the time to compare these elements ensures you’ll find a plan that suits both your health priorities and your budget.