Managing debt effectively can be a challenge, but it’s an important skill. Knowing how to take control of your debts in the UK can provide a sense of relief and financial stability. Making a clear plan to pay off debts while balancing daily expenses is key to effective debt management.

There are many strategies to address debts, from creating a budget to understanding interest rates and working with debt advisors. Seeking guidance from available support systems can also make a significant difference. Being aware of UK-specific legal frameworks can offer protection and help individuals manage their debt responsibly.

The goal is not just to clear existing debts but to maintain financial health and avoid future debt crises. Learning how to manage personal finances after successfully addressing debt problems is crucial. It ensures long-term financial health and stability.

Key Takeaways

- Create a plan to balance debt repayments and expenses.

- Understand UK debt solutions and legal protections.

- Maintain financial health to prevent future debt issues.

Understanding Debt in the UK

Debt in the UK comes in many forms, influenced by factors like personal spending habits and changing interest rates. Various debts can have different impacts on individuals, emphasising the importance of being well-informed.

Types of Debt

There are several main types of debt in the UK, including credit card debt, personal loans, mortgages, student loans, and payday loans.

Credit card debt is common due to convenience but can lead to high-interest charges if not paid off monthly. Personal loans, either secured or unsecured, are often used for larger purchases. Mortgages usually have lower interest rates but span many years. Student loans support education financing and are repaid based on income. Payday loans provide quick cash but carry very high-interest rates if not repaid promptly.

Understanding each type of debt and its terms is crucial. It helps individuals decide the best borrowing options and manage repayments effectively.

Causes of Debt Accumulation

Debt accumulation often results from several factors. Overspending is a primary reason, where spending exceeds income. This can come from lifestyle choices or unexpected events requiring urgent spending.

Inadequate financial literacy also plays a role. Without proper knowledge of interest rates and terms, people may take on unsustainable debt. Additionally, significant life changes like job loss, illness, or family emergencies can force individuals to borrow money.

Hence, staying informed and maintaining a clear budget is essential. This helps manage expenses and reduce the risk of accumulating unmanageable debt.

The Impact of Interest Rates

Interest rates significantly influence debt management in the UK. They determine how much extra borrowers pay over time. When interest rates rise, the cost of borrowing increases, affecting how quickly debt can be cleared.

This is particularly important for variable-rate loans and credit card balances, where payments can change based on the market rates.

In contrast, lower interest rates offer opportunities to refinance or pay off debts more quickly and save money. Thus, staying aware of economic conditions and how they affect interest rates can aid in more strategic debt management.

Strategies for Managing Debt

Managing debt involves keeping track of expenses, choosing the right repayment method, and exploring options like consolidation or refinancing. Each strategy offers unique benefits and challenges, helping individuals in the UK efficiently handle their financial obligations.

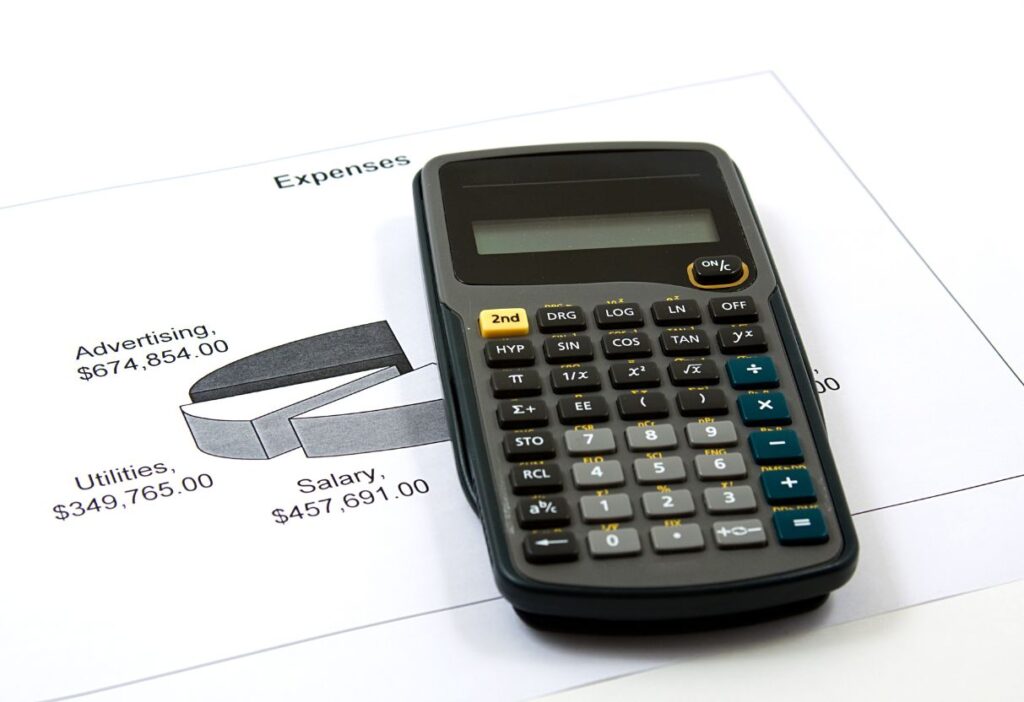

Budgeting and Expense Tracking

Effective budgeting is critical in managing debt. It involves listing all income sources and categorising expenses. This helps identify where savings can be made. Using tools like spreadsheets or apps can simplify tracking. Monthly budgets can ensure that individuals live within their means, preventing additional debt. Regularly revisiting the budget is vital to adjust for life changes, unexpected expenses, or fluctuations in income.

Debt Repayment Methods

There are several popular methods to manage debt repayment. One approach is the snowball method, where they pay the smallest debts first, gradually working towards larger obligations. Another is the avalanche method, which targets paying debts with the highest interest rates first. Prioritising high-interest debts can reduce long-term costs significantly. Successfully following any plan requires discipline and consistency.

Consolidation and Refinancing Options

Consolidation combines multiple debts into one payment, often with a lower interest rate. This reduces the number of payments and can make managing debt simpler. Refinancing is another option, where individuals replace existing debt with a new loan offering better terms. These strategies can lower monthly payments and interest rates. It’s important to research and consider all options carefully, sometimes seeking professional advice.

Legal Framework and Support Systems

Managing debt in the UK involves understanding how legal protections and available services can assist. It’s key to know about various advice options and consumer rights.

Debt Advice Services

Debt advice services are a vital resource for anyone struggling with financial obligations. Citizens Advice offers free and confidential advice. They help individuals understand their options and rights, often directing them to specialist organisations.

StepChange is another notable service, providing comprehensive debt advice. They offer practical guidance on budgeting, managing priorities, and dealing with creditors. Their solutions include debt management plans (DMPs) tailored to individual circumstances.

Local councils also provide resources and referrals to advice agencies. Engaging with these services can prevent escalation of debt problems and offer peace of mind.

Insolvency Solutions

Insolvency solutions are formal agreements that can relieve individuals from overwhelming debts. Bankruptcy provides a fresh start but has serious implications, including asset loss and impact on credit scores.

An Individual Voluntary Arrangement (IVA) is another option. It’s a legally binding agreement to repay creditors a portion of the debt over a fixed period. Compared to bankruptcy, an IVA can protect assets like a home.

For smaller debts, a Debt Relief Order (DRO) offers a low-cost alternative. It freezes debts for a year, after which they are written off if circumstances haven’t improved. Each option must be carefully evaluated based on personal circumstances.

Consumer Rights and Protection

Consumer rights and protections in the UK ensure fair treatment. The Consumer Credit Act regulates credit agreements, providing rights like detailed terms and transparent interest rates. This act offers protection against unfair changes in terms or extra charges.

If unfair practice is suspected, individuals can contact the Financial Ombudsman Service. This body helps resolve disputes between consumers and financial services. It ensures complaints are reviewed fairly and compensation is delivered when necessary.

The Insolvency Service provides information about rights during insolvency. This guidance is crucial when dealing with creditors, ensuring individuals are informed throughout the process. Understanding these protections can empower consumers in managing their debts.

Maintaining Financial Health Post-Debt

Recovering from debt requires staying financially healthy. Building a savings plan, using credit wisely, and seeking financial advice are key steps in ensuring lasting financial stability.

Building a Savings Plan

Creating a savings plan is crucial for financial health. It begins with setting realistic goals. He or she should identify essential expenses and savings targets. A simple budget can help track income and expenses. Tools like spreadsheets or budgeting apps make this process easier. By regularly saving a portion of income, even small amounts can grow over time.

Automating savings boosts success. Setting up automatic transfers from current accounts to savings accounts ensures consistent saving. This way, it’s a habit rather than an afterthought. Emergency funds are also important. They help cover unexpected costs and prevent reliance on credit in a crisis.

Using Credit Wisely

Credit can help or hurt financial health. Using it wisely means understanding different types of credit, like credit cards and loans. He or she should keep credit utilisation low, ideally below 30% of the total credit limit. Paying the full balance on time helps avoid interest charges.

Monitoring credit scores is important. Regular checks can identify errors or fraud early. Free credit reports are available annually from major credit reference agencies. They provide insights into spending habits and help improve financial strategies. Managing credit responsibly can improve credit scores and make borrowing cheaper in the future.

Seeking Financial Advice

Professional advice can guide financial decisions. Financial advisors offer tailored strategies for managing money. They can help develop long-term plans for saving, investing, and retirement. Choosing a reputable advisor is important; look for qualifications and reviews to ensure trustworthy service.

He or she might also explore government or charity services. These often provide free advice on budgeting and debt management. Workshops and seminars can also offer valuable information. Continuous learning about personal finance keeps one prepared for changes in one’s financial situation, keeping financial health on track.